Meet Rob. Rob is a cool guy. He has a career in Engineering and enjoys hobbies such as golfing, going to concerts and taking his dog for long hikes. Rob watches the news and has been keeping up to date with the rising home prices in the KW area. Rob is worried he won't be able to buy a home based on the current market trends and his lifestyle.

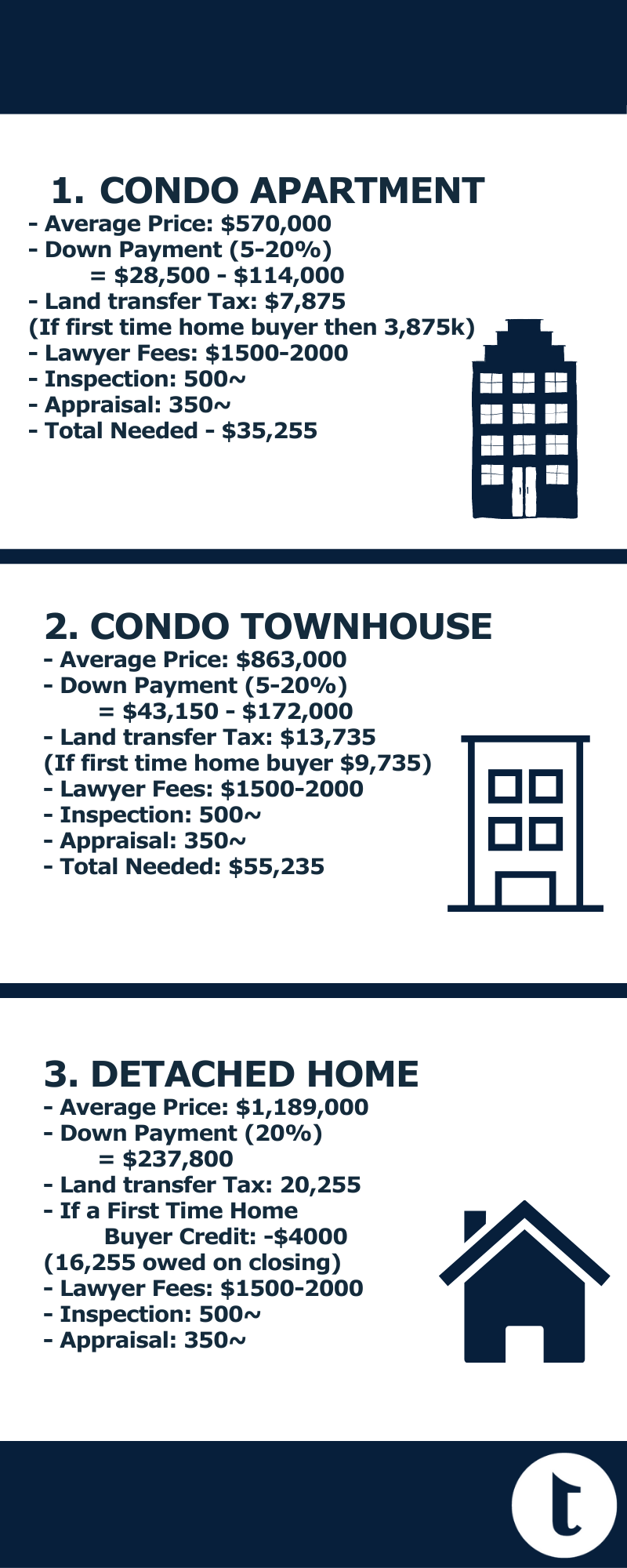

*Average prices based on Waterloo Region Feb 2022 #’s

Previous

Previous

THE 2022 BUDGET

Next

Next